Renuela Altar-Badayos

First of a two-part special report on alternative meats in the Philippines. – Read Story 2 here.

MANILA, Philippines — Homegrown plant-based startup Worth the Health Food’s (WTH) tagline is “crave good food” — or meals that are kind to people’s health and to the planet, and also taste as good as dishes made with conventional meat.

According to the Food and Agriculture Organization, interest in alternative protein sources has been increasing in recent years due to changing consumer tastes, the search for sustainable food systems, and growing environmental and ethical concerns around traditional protein production practices.

WTH, which markets its products under the Umani brand and also sells them at Umani Bistro kiosks, offers ground meat made of mung beans and texturized soy protein. It also sells pantry staples such as shredded meat, nuggets, corned “beef” and adobo flakes made with jackfruit, and sausage made with wheat and soy.

Its products are made from 100% plant-based ingredients and have no artificial preservatives, no cholesterol, no hormones, and no antibiotics.

“The population will grow, and we will have to double our livestock in order to satisfy the protein demands of the world. So we are looking for more sustainable ways to satisfy this [demand] for protein meat. One way is to look for alternative sources of protein. It could be from plant-based, fermentation or cultured meat,” said Carissa Lim, co-founder of WTH.

Unsustainable meat production

Cuts of meat on display at a supermarket in Quezon City on August 27, 2022.

In Asia, growing wealth and urbanization rates are fueling an increase in consumption of proteins such as meat and seafood. Asia Research and Engagement projected in 2018 that under a business-as-usual scenario, meat and seafood consumption in the region would increase 33% by 2030 and 78% by mid-century.

Continued reliance on meat as a protein source will create significant strains on the environment and people, such as rising greenhouse gas emissions, increased water use and pollution, growing land use, and antimicrobial use.

As it is, meat production is a major contributor to climate change. Livestock accounts for 14.5% of annual greenhouse gas emissions resulting from human activities. Cattle, which belch out potent greenhouse gas methane, represent about 65% of the livestock sector’s emissions.

A 2019 report by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services said that over a third of the world’s land surface and nearly three-quarters of available freshwater resources are devoted to crop or livestock production, driving ecological damage.

Feeding antibiotics to healthy animals to accelerate growth and prevent disease also causes microbes to become resistant. This is contributing to an increase in antibiotic resistant strains of bacteria in humans.

Mirte Gosker, acting managing director of alternative protein think tank Good Food Institute Asia Pacific, said that plant-based meat is crucial in changing the food trajectory “because of its potential to deliver all of the tastes and flavors consumers crave while also driving down land degradation, greenhouse gas emissions, and water use associated with meat production.”

GFI is a lobbying and consultancy group for alternative proteins.

Nascent, but growing

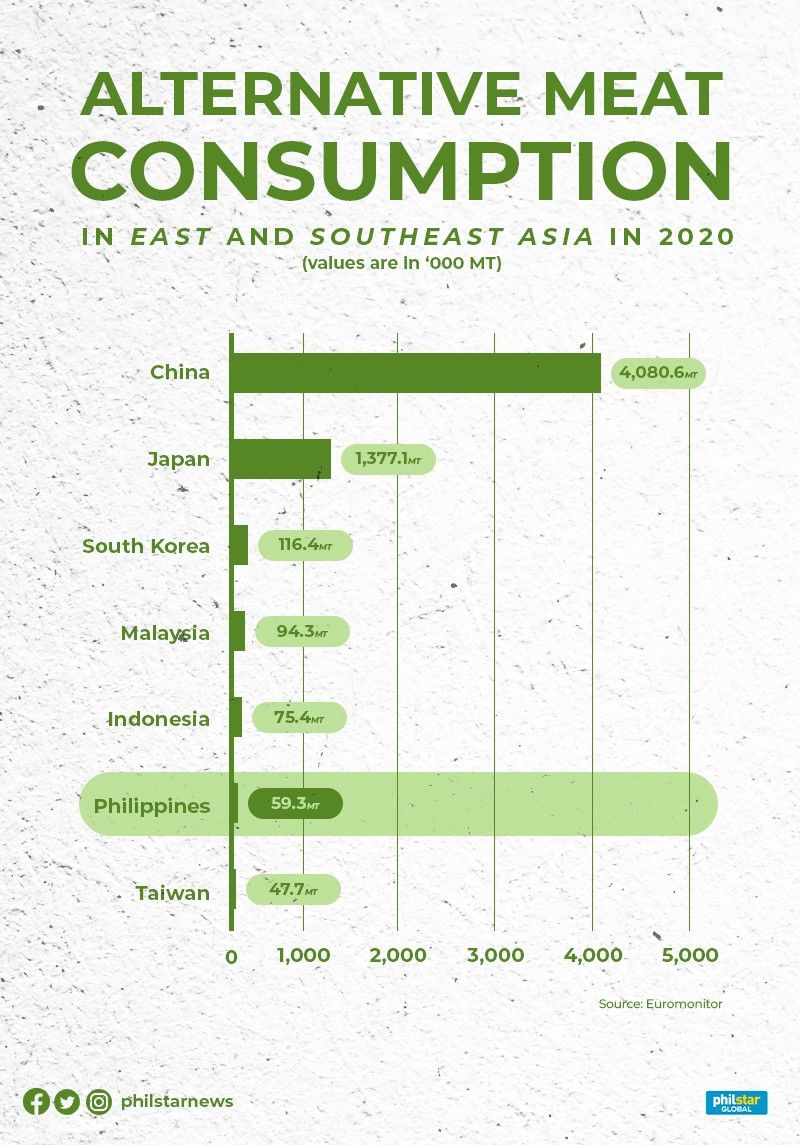

Data on alternative meat consumption in East and Southeast Asia in 2020.

The plant-based industry in the Philippines—a historically “meat-consuming country”—remains small. Data from Euromonitor showed that the Philippines lags behind neighboring Indonesia, Malaysia, South Korea, Japan, and China in terms of meat substitute consumption.

In 2020, the Philippines consumed just 59,300 metric tons (MT) of alternative meat products, far behind the region’s leading consumer, China, with 4.08 million MT.

The Philippines’ Department of Trade and Industry’s Bureau of Investments noted that the per capita consumption of meat alternatives was just 0.54kg. This is against the backdrop of the Philippines having a per capita GDP worth $3,301.2 versus China’s $10,408.7 that year, according to the World Bank.

GFI APAC pointed out that the percentage of total meat sales in the region was “vanishingly small” at 0.053% as of 2020 but, in a separate report, noted that investments in companies producing alternative proteins stood at $3.1 billion in 2020. The capital raised that year alone made up for over half of the total $5.9-billion worth of investments the industry saw in the past decade.

Investments in alternative protein companies last year further increased to $5 billion, covering 258 deals.

While industry investments in the region are ramping up, consumer demand in the Philippines is starting to grow as well.

“In terms of the meat alternatives market in the Philippines, it’s still at its early stages. It’s a relatively new category, but we are now seeing some positive shifts already,” Quorn Philippines Marketing Director Irish Tanchua said.

She also noted that the industry has been more active in the past two years and saw more players enter the arena.

For example, local food manufacturer Century Pacific Food, Inc. (CNPF) launched its own soy-based meat alternative brand “unMEAT” in 2020.

Nikki Dizon, CNPF’s general manager, said the company hoped to make its meat alternatives accessible both in terms of pricing and availability in stores.

Options going mainstream

Alternative protein products are displayed inside a freezer at a supermarket in Quezon City on August 27, 2022.

For the longest time, plant-based “meat” options were seen as hard-to-find, “luxury” items for a very niche and well-off market.

Now, alternative proteins are slowly penetrating local supermarkets and convenience stores in the Philippines through household brands. Plant-based or products marketed as vegan are also on the menus of some fast food chains in the country such as Burger King, Shakey’s and Starbucks.

In 2015, conglomerate Monde Nissin Corporation acquired Quorn, a leading meat alternatives brand in the United Kingdom. Monde Nissin made its stock market debut in Manila last year aiming to raise funds for the expansion of its Quorn business across the globe and strengthen its research and development efforts.

Quorn mycoprotein is made by fermenting a type of fungus called Fusarium venenatum, which was identified as one of the possible solutions to augment protein supply in case of a food shortage in the 1960s. Mycoprotein is sold in products that replicate minced meat, chicken fillets, nuggets and sausages.

CNPF said it had long been working on the technology for soy-based alternative “unMEAT,” which has raw materials that are sourced from across the world, but primarily from China.

“For years already, since the 1990s, this has been an endeavor that Century has been undertaking,” Dizon said.

“It just so happens that now more than ever, even on a global scale, the consumer demand for products that are healthier, more responsible, and more sustainable has risen. The consumer demand is shifting towards that.”

Two years into the plant-based protein business, Dizon said the company has seen “good acceptance” from both consumers and potential trade partners at home and abroad.

The company’s product line ranges from corned “beef” and nuggets to plant-based pizzas. It is also behind sister company fast food chain Shakey’s “Goood Burger” and “Goood Taco” pizza made with unMEAT products and plant-based cheese.

To make its plant-based products more accessible, CNPF also forged a partnership with convenience store franchise 7-Eleven.

While these options have already gone to the supermarket shelves, companies now face a new set of challenges after Russia’s invasion of Ukraine led to a “supply chain crunch” and affected inflation rates, leading to increased commodity costs.

“That’s why we currently employ various strategies when it comes to our buying and basically the end-to-end supply chain process for us to be able to minimize any further cost that we have to pass on to the consumers,” Tanchua said.

The ‘Filipino taste’

This “tuna” is made from soy and wheat.

Localization and taste, of course, play a crucial role in acceptance of plant-based protein in the Philippines, especially since some of the earlier brands of alternative “meat” products were imported.

“Introduction of plant-based proteins must accompany social marketing efforts and the major challenge actually is to recreate an appearance and the texture, including the flavor and the mouth fill of meat products,” said Imelda Angeles-Agdeppa, director of the science department’s Food and Nutrition Research Institute (FNRI).

Quorn Philippines’ Tanchua said that products that make it to the local supermarket shelves are “most aligned with the local palate.”

“Our key focus will always be on the product concept as well as, of course, the taste of the product. We’re trying to find those [products] that will be an optimum fit in terms of the local palate,” Tanchua said, adding that there are some products that fly well with UK consumers that their Manila product line does not have.

She said Quorn already expected some of its products to do well in Manila since consumers are more familiar with variants such as nuggets and sausages.

Meanwhile, CNPF said the first products they developed were specifically targeted for Filipinos such as tapa and tocino, which is also how WTH Foods is trying to attract younger Filipinos to shift to a healthier diet.

On top of imported proteins such as soy and wheat, WTH Foods Founder and CEO Stephen Co said they use a mix of locally-sourced vegetables and fruits for their products.

Co observed that some Filipinos are not as familiar with the plant-based products they sell.

“Sometimes they overcook it, sometimes it ends up being undercooked or it will be dry instead. They don’t have a good experience with the product so that’s why we decided to put up our own kiosk and offer cooked meals,” Co said.

WTH Foods also publishes recipes online that may serve as inspiration for its patrons and is partnering with other businesses, such as food kiosk Ate Rica’s Bacsilog, to introduce their products to a wider market.

More programs needed

Manufacturers, producers, and advocates of these products say that the industry in the country still has a long way to go.

The Board of Investments noted that the Philippines can further promote the industry and plant-based diets by using local crops that are good for the soil and other plants such as pigeon pea, cowpea, mung bean, and string beans.

However, Co said WTH Foods has difficulty sourcing raw materials locally, especially those which are bought from farmers’ cooperatives. Some crops are seasonal and the quality of raw materials is also an issue.

“We want to work with them on having consistent quality and having consistent availability of the supplies. That’s always our challenge,” Co said. Hurdles like these affect their production.

Co said progress has also been hampered by the lack of technology available in the Philippines and the lack of collaboration between the government and the alternative proteins industry.

“Since we are a startup, we don’t have enough money to put up a huge plant so we need support for infrastructure,” he said.

According to FNRI’s Angeles-Agdeppa, the country’s science department has no technology yet for plant-based proteins, but the development of plant-based meats is already included in its research and development roadmap.

She added that developing local technologies that will support the growing meat alternatives industry is still at the “infancy stage.” To overcome the challenges, the country will need much bigger funding to back research and development efforts on meat alternatives.

It would also take a while for the Philippines to be recognized as a producer of meat substitutes.

“The development of local plant-based proteins will be quite challenging to be at par with these technologies creating products that are already accepted by some consumers,” Angeles-Agdeppa said.

Despite this, the industry is seen to benefit from a “growing healthification trend” in the country on the back of a growing food and grocery delivery industry as the middle class expands. Fitch Solutions has projected that the disposable income of an “average Filipino household” will grow 8.4% annually over the medium term, hitting P567,900 in 2026.

“These households are likely to be more conscious of [the] health benefits of their food choices and have greater bandwidth when considering their dietary choices as they trade up price points for premium and healthier food options,” Fitch Solutions noted.

—

This article is part of the Earth Journalism Network’s special collaborative project on One Health and meat in the Asia Pacific entitled “More Than Meats the Eye.” It brings together eight media outlets from different countries and more than a dozen reporters to cover the impact of meat on animal, human and environmental health in the Asia-Pacific region.

Originally posted by Gaea Katreena Cabico, Kaycee Valmonte